Rsu tax calculator

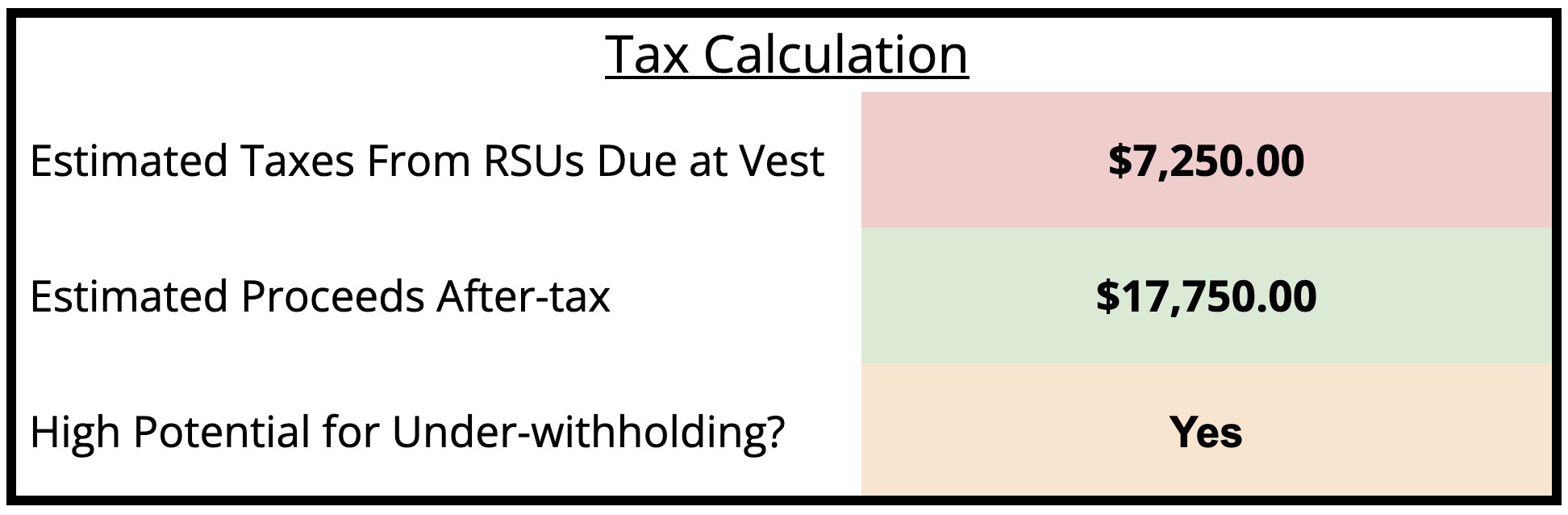

The calculator will show you the total sales tax amount as well as the county city. -100000 Total RSU Value After Tax.

Rsu Taxes Explained 4 Tax Strategies For 2022

Total RSU Value Before Tax.

. Income tax 112500 30 of. We created a free excel tool to help with that. You can use our Nevada Sales Tax Calculator to look up sales tax rates in Nevada by address zip code.

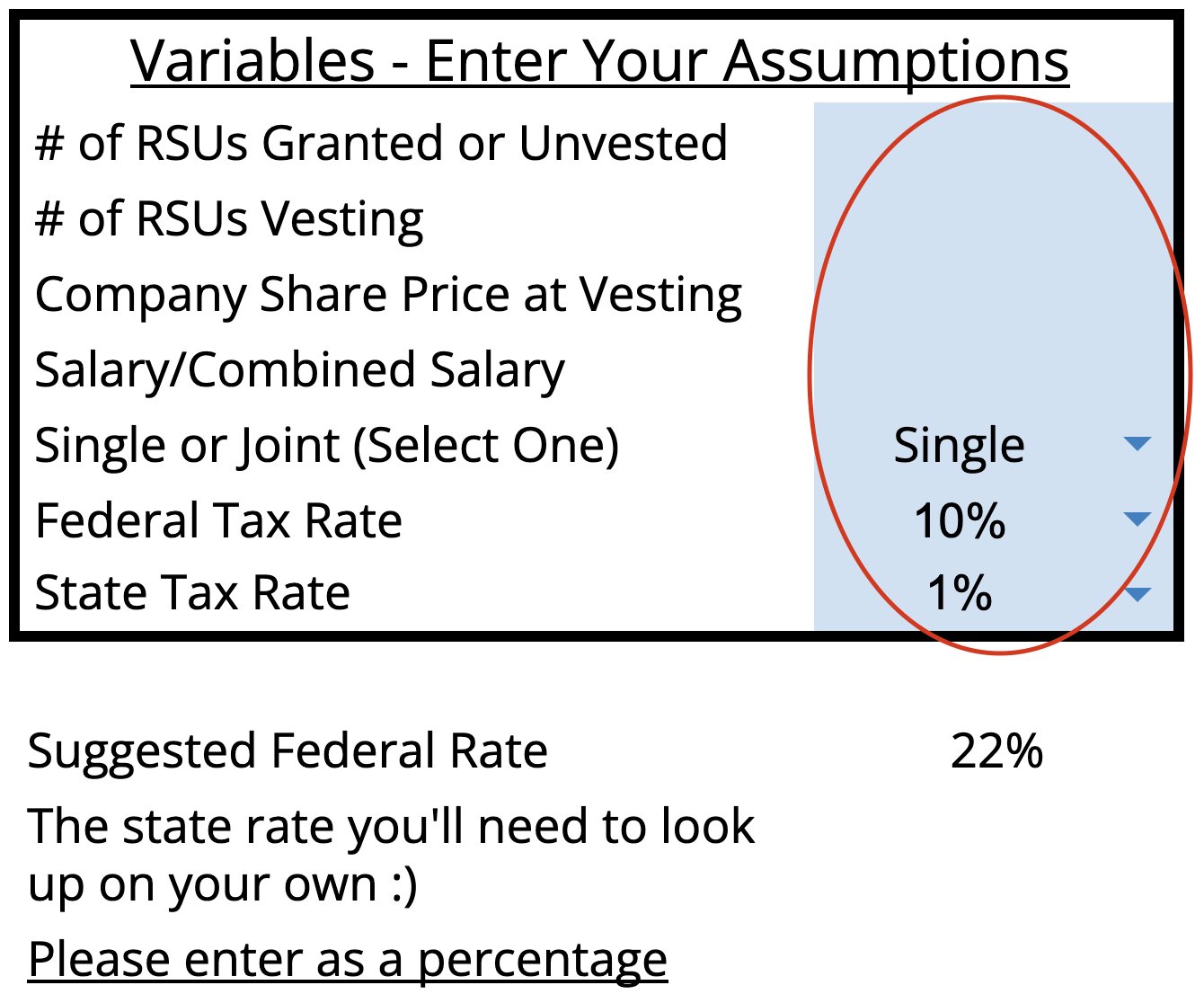

You are able to use our Nevada State Tax Calculator to calculate your total tax costs in the tax year 202223. Vesting after Social Security max. If you live in a state where you need to pay state.

RSU Tax Calculator. Compare how the total payout may change between options and RSUs. Ad Thinking of switching from stock options to RSUs restricted stock options.

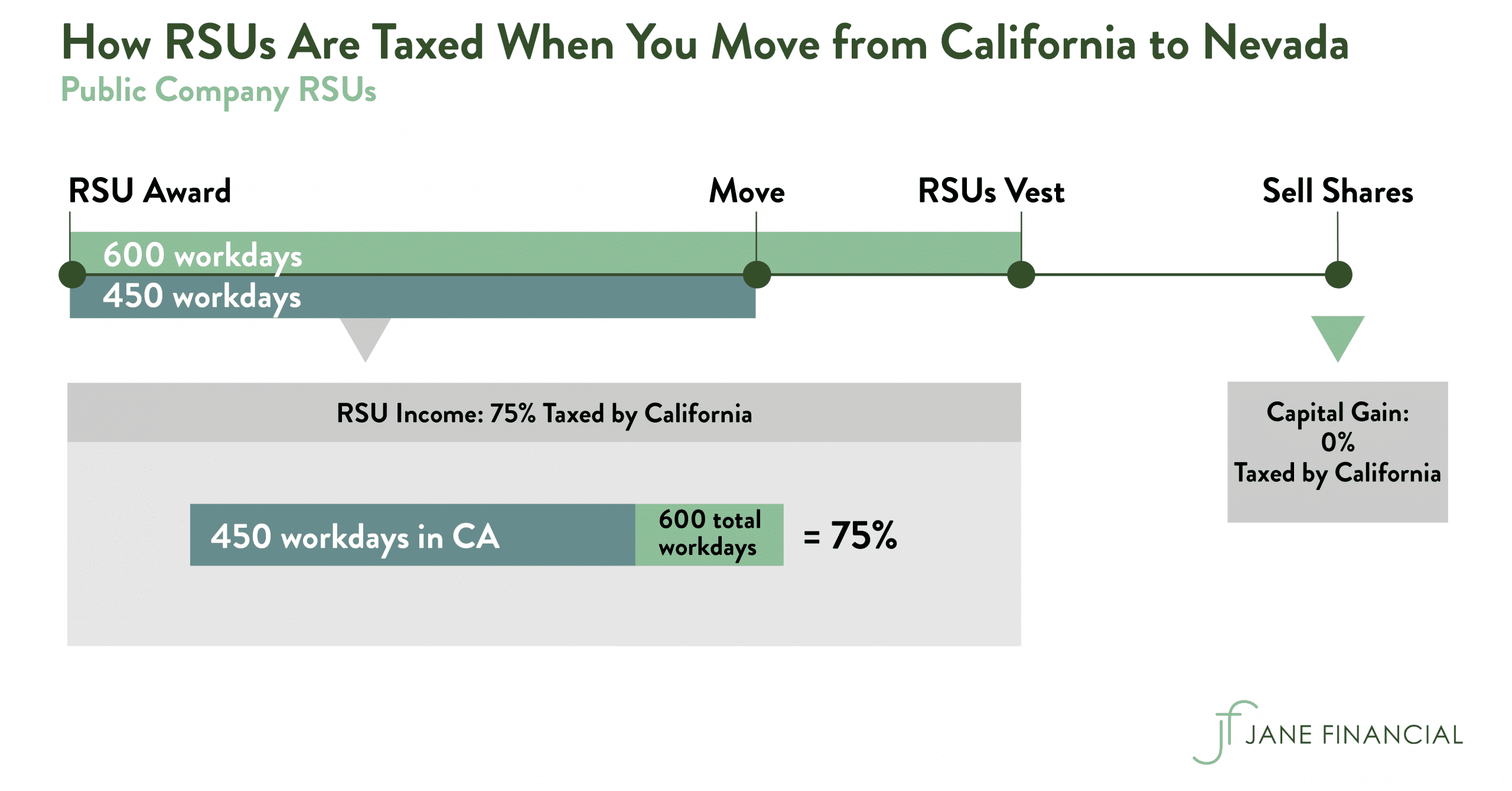

Your earned income is a simple calculation of the stock price on the day of vest multiplied by the number of shares vesting that day. If you choose to hold. For example if you are issued 10000 worth of RSUs as part of your compensation package you will pay ordinary income tax on 10000.

To use the RSU projection calculator walk through the following steps. This online calculator allows you to estimate both federal and state taxes due to an IPO or vested RSUs and is especially useful as it takes into account capital gains deductions and. The average homeowner in the state pays annual property taxes that are equal to 053 of their homes market value so annual property taxes shouldnt take a significant chunk out of your.

This includes the rates on the state county city and special levels. Multiply the tax rate from 2 by the gross value of the RSUs that vested and subtract the amount that was already withheld by your employer. Vesting after making over 137700.

Vesting after Medicare Surtax max. Basic Info for RSU Calculator Shares Granted Vesting Schedule Hypothetical Future Value Per Share Marginal Federal Tax Rate You can use the 2020 brackets below to estimate your tax. Using the RSU Projection Calculator.

Now that weve walked through how RSUs get taxed its time to actually calculate your tax bill. Las Vegas is located within Clark County Nevada. Nevada Salary Tax Calculator for the Tax Year 202223.

Enter the amount of your new grant whether an offer grant or an. The average cumulative sales tax rate in Las Vegas Nevada is 838. 1000000 Less Income Tax 62.

Restricted Stock Units Jane Financial

Restricted Stock Unit Rsu Tax Calculator Equity Ftw

Don T Pay Tax Twice On Rsu Sales Parkworth Wealth Management

When Do I Owe Taxes On Rsus Equity Ftw

Restricted Stock Units Jane Financial

Rsu Tax Rate Is Exactly The Same As Your Paycheck

Restricted Stock Units Jane Financial

Equity Compensation 101 Rsus Restricted Stock Units

Restricted Stock Unit Rsu Tax Calculator Equity Ftw

When Do I Owe Taxes On Rsus Equity Ftw

Rsu Taxes Explained 4 Tax Strategies For 2022

Restricted Stock Units Jane Financial

I Have Rsus But Didn T Sell Any Why Is My Tax Bill So Crazy Mana

Restricted Stock Unit Rsu Tax Calculator Equity Ftw

Rsu Calculator Projecting Your Grant S Future Value

Rsu Taxes Explained 4 Tax Strategies For 2022

Rsu Taxes Explained 4 Tax Strategies For 2022